By 2040, Southeast Asia is projected to contribute 56% of global EV sales, positioning the region as a major global hub (BloombergNEF, 2024). This surge will significantly drive demand for supporting infrastructure – especially charging stations – with electricity consumption expected to grow more than 260-fold. Leading this transformation are the ASEAN-6: Indonesia, Malaysia, Thailand, the Philippines, Vietnam, and Singapore.

Understanding the ASEAN EV Market

ASEAN is quickly advancing to become the #4 global EV market in 2035, closely catching up with China and the US. With a forecasted demand of 8.5M vehicles, ASEAN’s demand in aggregate will amount to more than half of the EU as the biggest market.

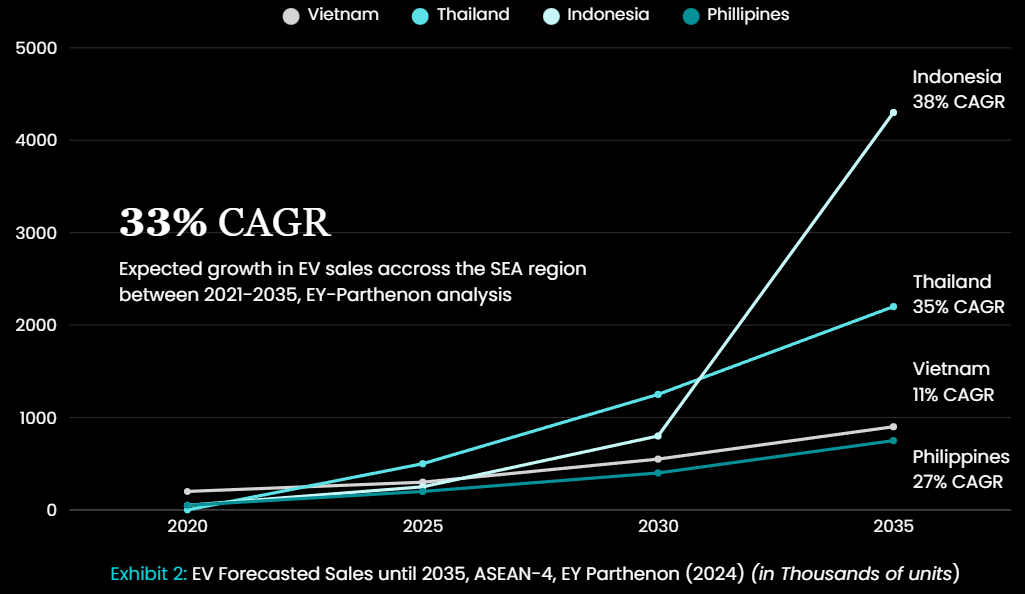

EY Parthenon forecasts Southeast Asia’s total EV sales volume to grow at 33% CAGR between 2021-2035. This translates into sales of 8.5 million units by 2035. Of these, Indonesia alone is expected to contribute over half of the region’s volume, with forecasted sales of close to 4.5 million units. Thailand is predicted to closely follow this growth trend with an estimated sales volume above 2 million units, among their 4 times smaller population than Indonesia. Vietnam also boasts high EV sales volumes, leveraging on the growth potential of VinFast, a subsidiary of leading conglomerate Vingroup, which has invested significantly in cutting-edge, highly automated production lines forecasted to manufacture up to 950,000 units per year by 2026.

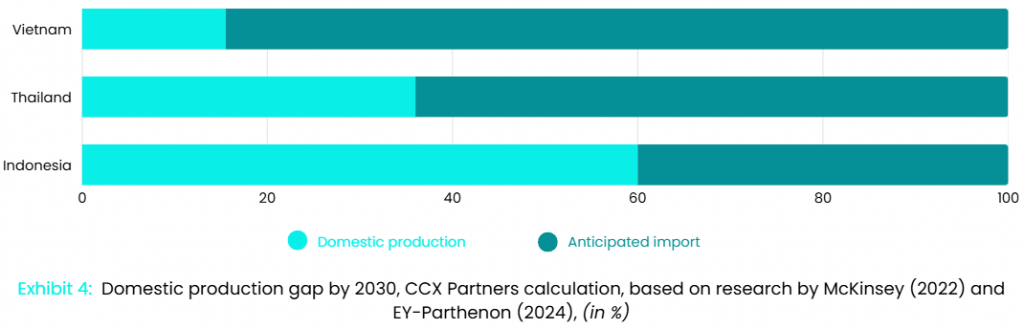

While the EV production in ASEAN’s top 4 economies, incl. Singapore and India, is expected to rise at 45% CAGR (‘22-’30), this will not be sufficient to keep pace with the already much higher demand, growing at 33% CAGR (‘21-’35). Exhibit 4 underlines this, showing that Indonesia as the largest market will depend to 40% on imports of EVs in 2030, with Thailand and Vietnam much higher at around 64% and 84%.

Much of this extra demand is being filled by Chinese companies. China’s established EV technology has found a rapidly maturing market in Southeast Asia. Asia-based TMT-focused research firm Counterpoint reported a significant uptick in market share for Chinese auto companies in Southeast Asia last year, jumping from 38 percent in 2022 to nearly 75 percent in 2023.

Regulation & Infrastructure Readiness in ASEAN

McKinsey shared 4 dimensions across which political stakeholders can structure their work to strengthen both the demand for EVs as well as the production of vehicles in the region.

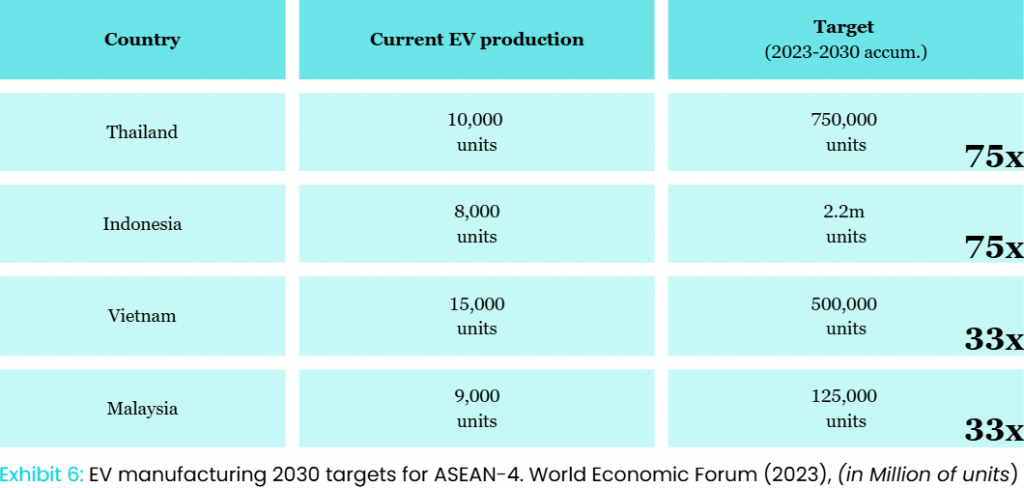

1/ Set EV manufacturing targets

By establishing clear EV production goals, Thailand, Indonesia, Malaysia and Vietnam are signaling their commitment to the EV sector, which in turn attracts investment from major automotive manufacturers and stimulates the development of local supply chains for EV manufacturing.

This comprehensive approach ensures that SEA can fully benefit from the environmental, economic and social advantages of widespread EV adoption, while also growing independent from other market players in the US, EU and China.

2/ Ban Internal Combustions Engines (ICE)

All ASEAN-6 markets have undertaken initiatives to phase out or at least limit the presence of conventional ICE cars (Internal Combustion Engines). Only the Philippines have not yet announced such initiative, while a similar decree is in progress.

3/ Grant Consumer Subsidies

While ASEAN countries increasingly view EV manufacturing as a step into achieving economic growth, EV readiness presents a significant challenge to the achievement of these goals. Decisive action from ASEAN governments is required – and in fact underway, with Vietnam and Thailand deploying 4 different measures each

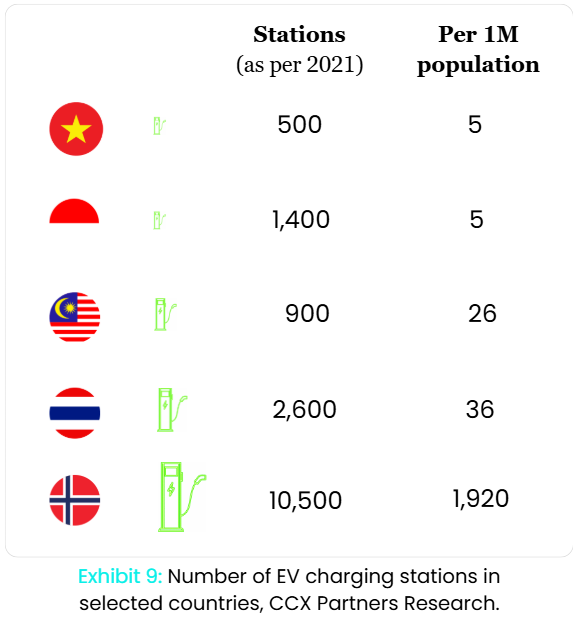

4/ Build more EV Charging Infrastructure

EV adoption can only accelerate on the back of a tight net of charging stations. The world’s most EV friendly country, Norway, has between 50 and 400 times more charging station per 1M population than ASEAN’s 4 most promising EV markets.

Public and private efforts are required to ensure infrastructure readiness to promote EV adoption. This challenge is as true for ASEAN’s top four markets, as it is for any other global market aiming to normalize EVs on their streets. However, more needs to be done by ASEAN’s governments on this journey.

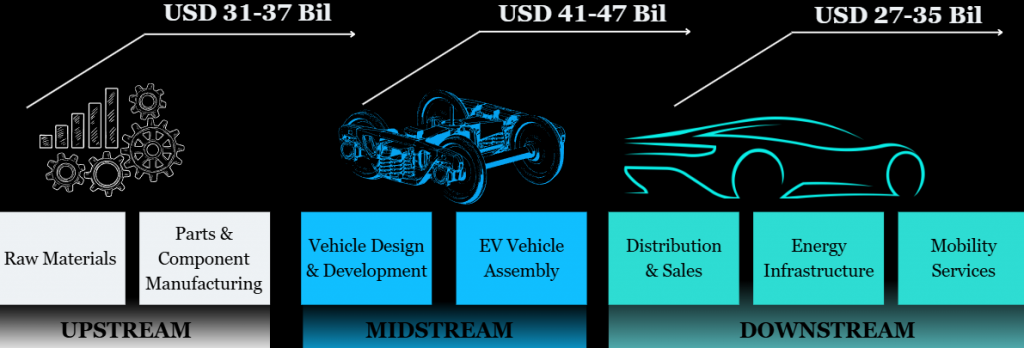

The ASEAN EV Value Chain

The EV market in Southeast Asia is picking up exponential growth as it starts to outgrow its infancy stage. The increasing adoption in the mass market segment drives the interest of automotive manufacturers and suppliers all across the value chain, encompassing components, batteries, and infrastructure. This optimistic outlook for the EV market in Southeast Asia propells enhanced collaboration, gradually deepening the level of coverage of the domestic value chain.

To achieve their EV ambitions, Southeast Asian countries are investing heavily in local production, aiming to enhance affordability and boost supply. These supply-side initiatives complements demand-side measures such as tax cuts and purchase subsidies on imported models, creating a comprehensive strategy to accelerate EV adoption. While Thailand, Malaysia, and to an extent also Indonesia can develop their EV supply chains on the back of decade-long experience of building ICE cars domestically, especially Vietnam is newer to the mobility value chain, albeit catching up fast.

ASEAN EV Upstream Market is Dominated by Indonesia and Thailand

Thailand, with over 2300 suppliers, is a leader due to its well-established automotive sector, which smoothly transitions into EV components production. It excels in manufacturing chassis, body parts, and electrical systems, exporting these components extensively within ASEAN and to global markets. Thailand produced approximately 1.88 million vehicles in 2022, bolstered by strategic government policies, making it a unique hub in the region.

Indonesia, with approximately 1500 suppliers,¹⁹ leverages its robust automotive foundation to expand into EV components. The country is strong in producing raw materials and mechanical parts, including motors and inverters. Its rich reserves of nickel and other essential minerals for EV manufacturing give it a unique advantage. Indonesia produced around 1.47 million vehicles in 2022,²⁰ exporting components primarily within ASEAN and to East Asian markets, making it a crucial player in the regional supply chain.

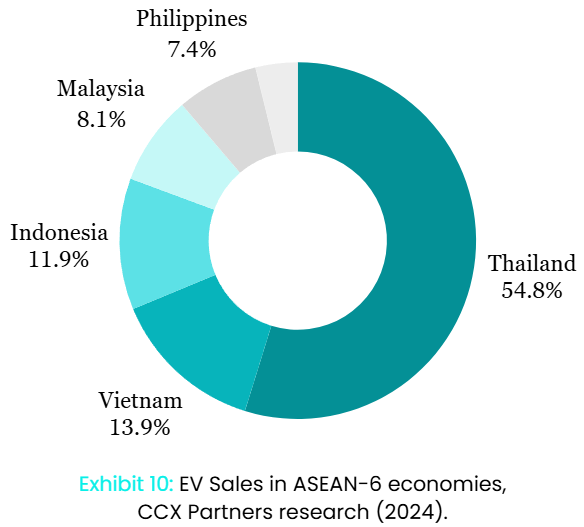

Midstream: EV Sales Largely Captured by Thailand while Indonesia and Vietnam are Catching Up

Thailand, boasting the strongest automotive industry in the region, saw over 59% of EV sales in Southeast Asia in 2022. This success is driven by significant foreign direct investment from German, Japanese, Chinese, and Korean automakers, coupled with comprehensive policies linking electromobility to smart grids and automation. In 2023, EV sales in Thailand grew 8-fold to over 78,000. This accounted for 12% of all vehicle registrations in the country in 2023. Besides fully built-up vehicles, Thailand excels in exporting EV components like electric motors, converters, and inverters, and has a strong position in conventional starter battery production and exports (ranked 8th in exporting electrical static converters globally).

Indonesia, with the world’s largest nickel deposits, attracts global automakers from China, Japan, Korea, and the US, despite concerns over regulatory stability. ASEAN’s largest member state hosts already five EV manufacturers, namely South Korea’s Hyundai, Japan’s Mitsubishi, and China’s Wuling, Chery, and DFSK. Experts estimate the country’s EV production capacity could reach 500,000 by 2030.²⁷ In 2023 it realised around 10% of that potential, with 50,000 EVs sold.

Downstream Market is Developing, as EVs Have Arrived in the Spotlight, Following the Significant Sales Growth in 2023

The downstream EV value chain in ASEAN presents a dynamic landscape, with significant variations across Malaysia, Vietnam, Indonesia, and Thailand.

In 2023, Thailand led the region with 78,314 EVs sold, marking a 684% increase from the previous year and accounting for 12% of total vehicle registrations. Thailand’s robust market is bolstered by advanced EV assembly plants, comprehensive distribution networks, and extensive charging infrastructure, positioning it as a regional leader.

Indonesia, closely following, recorded approximately 50,000 (target 2024) – 17,051 (recorded 2023) EV sales in 2023. The country is rapidly expanding its EV dealership and service networks, driven by government incentives and improvements in charging infrastructure.

Vietnam, with 19,960 (estimated) – 34,855 (recorded) – EVs sold in 2023, is developing its downstream capabilities by focusing on expanding EV distribution and service networks.

Malaysia, with 13,257 EVs sold in 2023, is advancing its EV market through partnerships with international car manufacturers and enhancing its charging station network, although it lags behind its regional peers.

Opportunities and How To Enter ASEAN EV Market

Navigating the unique characteristics of each ASEAN country is essential. Differences in legal systems, cultures, and languages require businesses to have deep local understanding. Limited economic integration within ASEAN further necessitates tailored approaches for each market.

Free trade agreements, particularly Vietnam’s with the EU, have facilitated trade and attracted investment, boosting the region’s appeal to EV industry stakeholders.

Increasingly, more companies in both the B2C and B2B spheres are eyeing the ASEAN EV market, but several critical questions need addressing:

For detailed guidance on navigating the complexities of entering the EV markets in Vietnam, Thailand, Indonesia, and Malaysia, please reach out to us today! Our market entry consulting firm is equipped to provide tailored advice and support to ensure successful ventures into the ASEAN EV industry.