The economic magic since 1986

Following the initiation of Đổi Mới in 1986, alongside advantageous global trends, Vietnam propelled itself from one of the globe’s poorest nations to achieving middle-income status within a single generation. Furthermore, Vietnam’s vigorous pivot from an agriculture-based economy to one focused on industrialization and modernization has positioned the country as a global manufacturing hub.

Exhibit 1. Vietnam’s GDP over the years

Manufacturing: Springboard of Vietnam’s economy

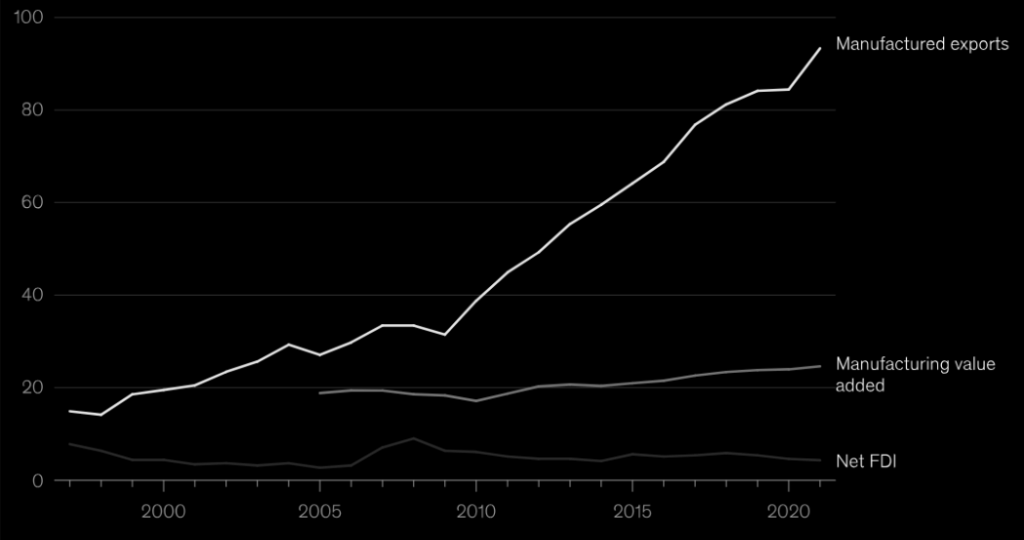

In 2022, Vietnam’s manufacturing sector accounted for 24.76 percent of the country’s total GDP, reaching a value of over 2.3 thousand trillion Vietnamese dong (Statista, 2023). Since 2009, there has been a notable surge in manufactured exports, constituting nearly 95% of the GDP share at present.

Source: UN

Exhibit 2: Manufactured exports, manufacturing value added, and FDI in Vietnam as a share of GDP from 1997-2021, %

Manufacturing transformation

Vietnam’s manufacturing sector has undergone significant growth and structural changes over the past two decades.

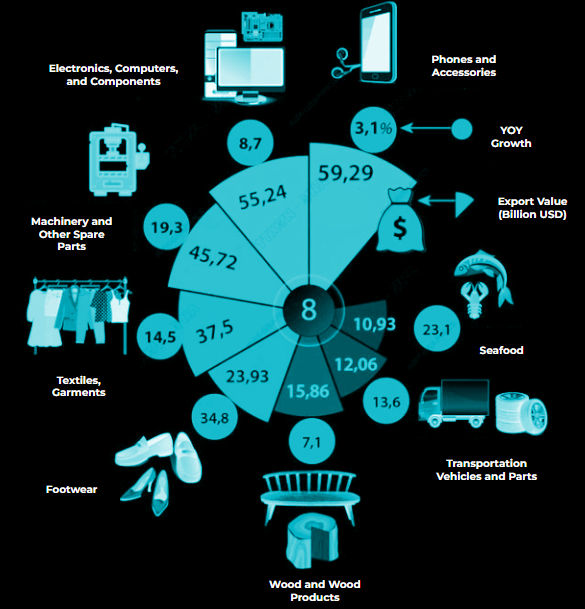

The export value of the machinery and electronics industry group has seen a remarkable surge since 2012, surpassing textiles and garments to become the leading export industry.

This shift indicates a shift in industry direction from low-value-added products like clothing and footwear to higher-value items such as electronics and components.

Diverse manufacturing facets in Vietnam

Exhibit 4: Vietnam’s Industrial hub distribution

Northern Region

The total industrial land area is concentrated in 5 key provinces: Hanoi, Hai Phong, Bac Ninh, Hung Yen, Vinh Phuc with about 10,000 hectares.

With a comprehensive and synchronously developed transportation network, along with a strategic location, it has created favorable conditions for transportation in the region and inter-region easily, making the Northern industrial market a bright choice for global manufacturers.

Central Region

In the Central region, Da Nang and Quang Nam lead industrial activity among the 14 provinces and cities, with a 67% occupancy rate over 7,500 hectares of industrial land. The key industrial groups of the Central region are the food processing industry, heavy industries, oil and gas & energy.

Due to a late start, the Central region’s industrial market has slower growth compared to the Northern and Southern regions, however, this also translates to abundant resources and the most potential for development.

Southern Region

In the South, Ho Chi Minh City and neighboring provinces are the economic powerhouses. These areas offer over 25,000 hectares of industrial land with a 98% occupancy rate.

As a long-standing industrial center, the South concentrates a large number of traditional industries, such as rubber and plastics, and textile and garment industries.

Key manufacturing sectors

In Vietnam, thanks to cheap labor, qualified human resources, supportive policies for foreign investment,. electronics, computers & components, have emerged as the primary contributors to the country’s manufactured exports, underscoring the high-value-added transformation within Vietnam’s manufacturing sector.

Electronics components

The two leading industries in Vietnam are components for phones and computers, boasting a combined export turnover of over 110 billion USD in 2022. These have been at the top of the list of Vietnam’s export products for many years, hosting major electronics giants like Samsung, Apple, LG, and Apple. To further improve the sector’s competitiveness in the ever-developing global market, Vietnam is strengthening technology research and development, promoting product innovation.

Textiles and garment

In 2022, the export turnover of textiles and garments surged to 37.5 billion USD, marking a 14.5% increase compared to 2021. The primary export items include traditional textile products, fabrics, fibers, and textile accessories.

In terms of markets, the United States, Japan, and South Korea stand out as the top three importers of Vietnamese textiles and garments, accounting for 65.89% of the total export turnover of textiles and garments of Vietnam to other countries by February 2023.

Inside-Out drivers for the robust growth

Powerful inner forces

Densely distributed industrial hubs (IP) and economic zones (EZ)

By the end of 2021, Vietnam had 564 IPs incorporated into the planning, spanning a collective area of 211,700 hectares. Additionally, the country boasts 18 EZs spread across 17 provinces and cities, encompassing an area of 871,500 hectares. Currently, Vietnam hosts three high-tech parks, located in Ho Chi Minh City, Hoà Lạc in Hanoi, and Đà Nẵng.

Strategic location for global supply chains

Situated closely to major markets such as China, India, and other ASEAN countries, Vietnam serves as a pivotal link connecting various regions. Along with its extensive coastline, Vietnam can facilitate efficient trade and lower logistic costs, rendering itself an ideal distribution center for businesses wanting to enter Asian burgeoning markets.

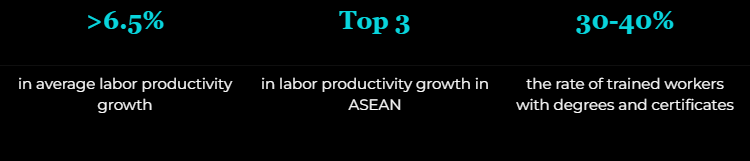

Cost advantages and competitive labor market

Vietnam is touted as a low-cost manufacturer with competitive labor costs. On average, Vietnam’s labor costs are half as much as China’s labor costs at US$2.99 per hour compared to US$6.50 per hour respectively (Statista, 2024). This contributes to Vietnam’s increasing position as a more cost-effective alternative to its regional counterparts.

Attractive government laws and incentives

Vietnam boasts a robust legal framework and attractive incentives aimed at fostering manufacturing growth and enticing global manufacturers. In the last few years, the government has applied many tax incentives for foreign businesses, as well as incentives for projects in new sectors like renewable energy, electronic products, etc.

External favorable conditions

China+1 strategy

Following the US-China trade tensions, global supply chains have undergone restructuring, with many businesses adopting strategies to diversify risks. Vietnam has emerged as a favored destination, often referred to as a “China plus one” option, thanks to its lower labor costs, especially in electronics and supply chain sectors.

In September 2023, Intel began expanding its Phase 2 chip verification plant in Ho Chi Minh City with a $4 billion investment. Boeing and Google also announced plans to expand their supplier networks and manufacturing bases in Vietnam after researching the local investment environment.

Robust FDI inflow to Vietnam

By the close of 2023, Vietnam had attracted approximately $36.61 billion in foreign direct investment (FDI), marking a significant 32.1% increase compared to the previous year. These ever-growing capital flows act as a powerful economic catalyst, nurturing extensive growth and propelling developments. The manufacturing sector emerged as the primary recipient of FDI, with around $23.5 billion invested, solidifying its pivotal role in Vietnam’s export-driven economy.

Future Outlook: from Cost-Efficiency to Productivity

2030 Manufacturing target

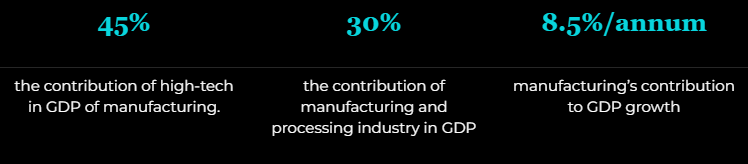

Vietnam aims to achieve a modern, competitive industry with high added value in global value chains by 2030 as outlined in the approved master plan on industry and trade sector restructuring.

Upskilling the workforce

Vietnam’s manufacturing prowess has traditionally relied on cost-effective labor, yet amid shifting global dynamics and technological advances, there’s a pressing need to shift towards productivity and innovation to maintain competitiveness and ensure economic resilience. To address this, Vietnam aims to lead ASEAN in labor productivity improvement by 2030:

Endnote

If you are a foreign investor looking to build a lasting business in Vietnam, several key guidelines should be considered. We recommend familiarizing yourself with local regulations and business practices, engaging in thorough market research to understand consumer preferences and industry dynamics, and cultivating strong relationships with local partners and stakeholders to navigate the business landscape effectively. However, the complexity of market entry and growth strategies in Southeast Asia can pose additional challenges.

That’s where CCX Partners steps in. With our extensive experience, strategic insights, and locally-global approach, we empower businesses to navigate complexities and seize opportunities in the Vietnamese market. Let CCX Partners be your guide on the journey to success in Vietnam’s thriving manufacturing landscape.